In today’s fast-paced financial environment, lenders face growing challenges in managing loan portfolios efficiently, ensuring compliance, and delivering excellent customer service. Traditional manual processes can no longer keep up with the increasing demand for accuracy, speed, and transparency. That’s where loan management software steps in — revolutionizing how financial institutions, credit unions, and alternative lenders operate.

Loan management software is designed to automate and streamline the entire loan lifecycle, from application and origination to servicing and collections. By adopting a robust digital solution, lenders can significantly improve operational efficiency, reduce risks, and provide a better customer experience.

What is Loan Management Software?

Loan management software is an end-to-end system that helps financial institutions manage every aspect of the lending process. This includes automating loan approvals, maintaining borrower records, managing repayment schedules, monitoring delinquencies, and generating reports. By centralizing these processes, lenders can ensure consistency, improve accuracy, and reduce the time and effort required to manage loans manually.

With the increasing complexity of regulatory requirements and the need for quick, data-driven decisions, having a reliable loan management software solution is becoming not just beneficial but essential for lenders of all sizes.

Key Features of Loan Management Software

A well-designed loan management software typically offers a wide range of features, each aimed at optimizing different stages of the lending process:

- Loan Origination and Underwriting

The software simplifies the application and approval process by offering online forms, document upload capabilities, automated credit checks, and decision-making workflows. This allows lenders to quickly assess borrower eligibility and make informed decisions based on real-time data. - Payment Scheduling and Processing

Managing payment schedules can be a complex task, especially when dealing with multiple loan products. Loan management software automates repayment scheduling, reminders, and collection, minimizing missed payments and improving cash flow for lenders. - Compliance Management

Compliance with financial regulations is critical. The software often includes built-in features to ensure that all loans meet local and international regulatory requirements. It also maintains audit trails, making it easier to prepare for inspections and audits. - Risk Assessment and Monitoring

Sophisticated loan management software integrates credit scoring, risk profiling, and performance monitoring, enabling lenders to manage portfolio risk proactively. It helps identify at-risk accounts early, allowing for preventive action. - Customer Relationship Management (CRM)

Customer satisfaction is key in today’s competitive market. Many solutions include CRM features, such as communication tracking, personalized messaging, and customer portals, providing a better borrower experience throughout the loan lifecycle. - Reporting and Analytics

Data-driven decision-making is vital. The software offers customizable dashboards and detailed reports, helping lenders monitor key performance indicators (KPIs), track portfolio health, and identify growth opportunities.

Benefits of Using Loan Management Software

Implementing loan management software offers a range of benefits that can transform a lending operation:

- Efficiency Gains

Automation reduces the need for manual processing, freeing up staff to focus on high-value tasks such as customer engagement and business development. - Improved Accuracy

By minimizing human error, the software ensures that records, calculations, and communications are precise and reliable. - Enhanced Compliance

Built-in compliance checks help institutions stay on the right side of regulations and avoid costly penalties. - Faster Loan Processing

With automated underwriting and approvals, loan applications can be processed in minutes rather than days, leading to higher customer satisfaction. - Cost Savings

By streamlining operations, institutions can cut down on administrative expenses and lower the cost of loan servicing. - Scalability

As a lender’s portfolio grows, loan management software can easily handle increased workloads without the need for significant additional resources.

Choosing the Right Loan Management Software

When selecting a loan management software solution, lenders should consider several factors:

- Customization: Choose a system that can be tailored to your specific loan products, processes, and regulatory environment.

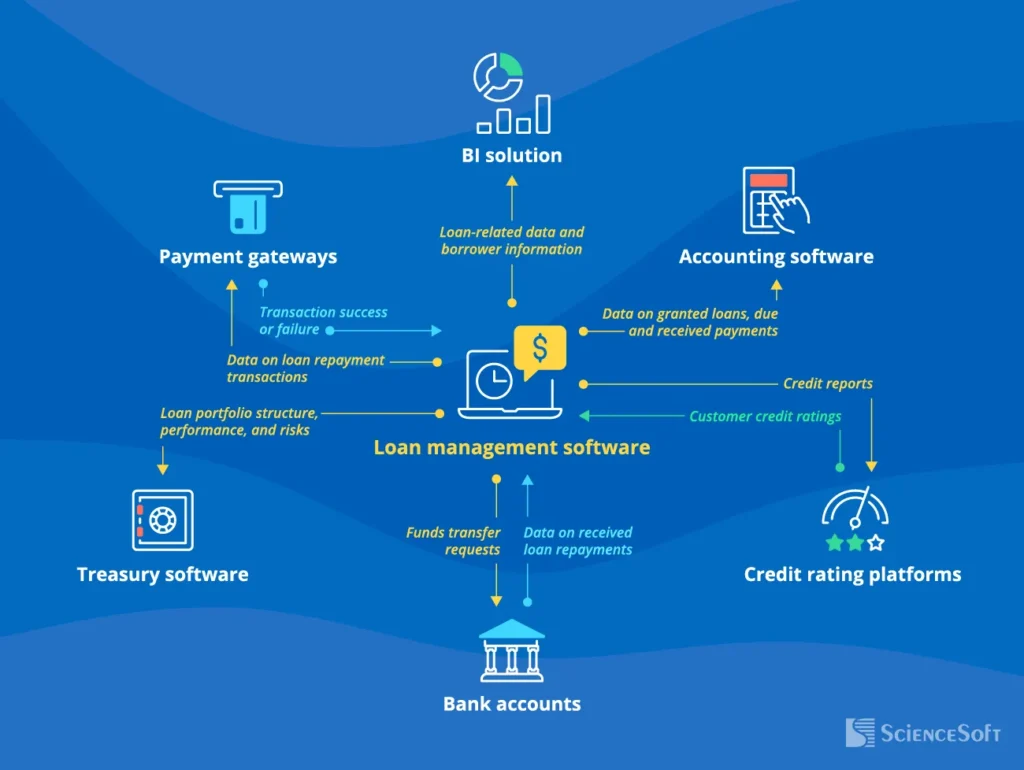

- Integration: Look for software that can integrate with your existing systems, such as accounting software, credit bureaus, and CRM tools.

- User-Friendliness: A clean, intuitive interface ensures quicker onboarding for staff and a better user experience for borrowers.

- Security: Ensure that the software has strong security features to protect sensitive borrower information.

- Support and Updates: Opt for a provider that offers reliable customer support and regularly updates the software to stay ahead of regulatory changes and technological advancements.

The Future of Loan Management Software

As financial technology continues to evolve, the future of loan management software looks promising. Artificial intelligence (AI) and machine learning (ML) are beginning to play a larger role, enabling more accurate risk assessment, fraud detection, and personalized customer experiences.

Blockchain technology is also emerging in the lending space, offering increased transparency, security, and efficiency in loan contracts and payments. Furthermore, cloud-based loan management software is becoming increasingly popular, allowing for greater flexibility, scalability, and cost-effectiveness.

Financial institutions that invest in advanced loan management software today will not only improve their current operations but also position themselves for greater success in a highly competitive and digital future.

Conclusion

Adopting loan management software is no longer optional for lenders who wish to remain competitive in a rapidly changing financial landscape. By streamlining operations, ensuring compliance, enhancing the customer experience, and enabling data-driven decisions, this technology empowers institutions to lend smarter and grow faster. Whether you are a small credit union or a large financial enterprise, investing in the right solution can transform your lending operations and set you on a path to long-term success.